Integrating the Commercial Registration Electronic System into Your Company Formation Technique

Wiki Article

Navigating the Complex Globe of Company Formation: Insights and Strategies

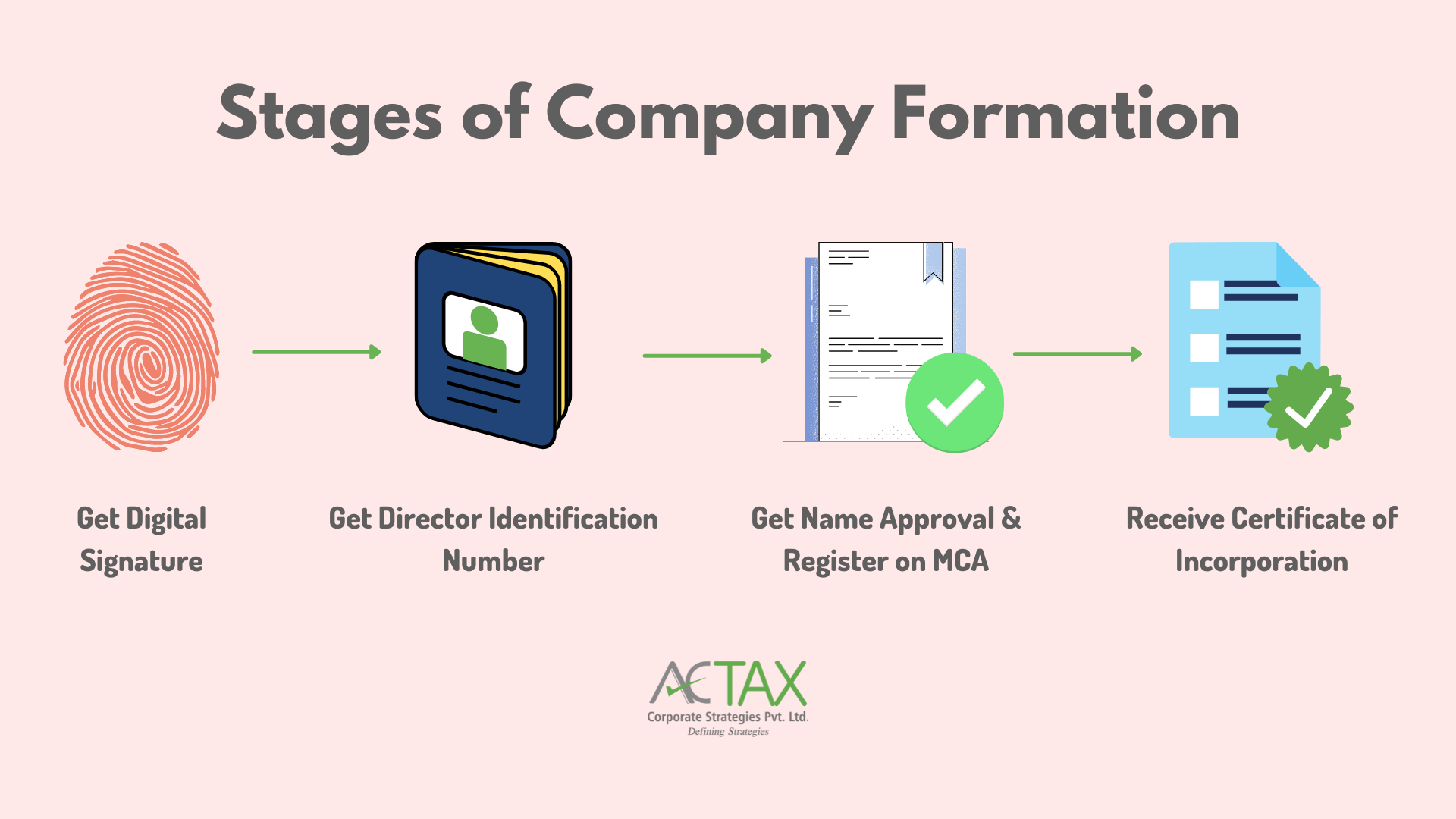

As business owners set out to browse the complex globe of firm formation, it becomes crucial to furnish oneself with a deep understanding of the intricate nuances that define the process. From picking the most ideal organization structure to guaranteeing rigorous lawful conformity and developing efficient tax obligation preparation techniques, the path to creating a successful organization entity is riddled with intricacies.Organization Framework Selection

In the realm of company development, the vital decision of selecting the ideal organization framework lays the foundation for the entity's functional and lawful structure. The choice of business structure dramatically impacts numerous facets of the organization, including tax, liability, monitoring control, and conformity needs. Business owners should meticulously examine the available choices, such as sole proprietorship, partnership, limited obligation business (LLC), or company, to identify one of the most suitable structure that straightens with their business objectives and conditions.One common structure is the single proprietorship, where the service and the proprietor are taken into consideration the same lawful entity - company formation. This simplicity permits ease of formation and complete control by the proprietor; nonetheless, it also requires limitless individual responsibility and potential difficulties in increasing resources. Partnerships, on the other hand, include two or even more people sharing profits and losses. While partnerships use common decision-making and resource pooling, companions are directly responsible for business's responsibilities and debts. Understanding the nuances of each service framework is important in making an educated decision that establishes a solid groundwork for the company's future success.

Lawful Conformity Fundamentals

With the structure of a suitable organization framework in area, making sure legal compliance essentials comes to be extremely important for protecting the entity's procedures and maintaining regulative adherence. Lawful compliance is crucial for companies to operate within the boundaries of the legislation and avoid potential penalties or legal issues.To ensure legal conformity, companies should frequently evaluate and update their treatments and plans to reflect any kind of modifications in guidelines. Looking for lawful counsel or compliance experts can better aid companies browse the intricate legal landscape and remain up to date with evolving regulations.

Tax Obligation Preparation Considerations

Furthermore, tax preparation must incorporate methods to capitalize on readily available tax deductions, debts, and motivations. By purposefully timing revenue and costs, services can potentially lower their taxed earnings and overall tax concern. It is additionally essential to stay educated regarding changes in tax obligation legislations that might affect the business, adjusting approaches as necessary to remain tax-efficient.

Moreover, global tax preparation considerations might arise for organizations running across boundaries, entailing complexities such as transfer pricing and foreign tax credit ratings - company formation. Looking for support from tax obligation professionals can help navigate these intricacies and establish a comprehensive tax obligation plan customized to the business's requirements

Strategic Financial Management

Efficient economic management involves a thorough method to looking after a business's financial sources, read what he said financial investments, and total monetary wellness. By producing in-depth spending plans that align with the business's purposes and objectives, services can designate sources efficiently and track efficiency versus economic targets.

An additional vital facet is money circulation administration. Keeping an eye on cash money inflows and outflows, taking care of operating resources efficiently, and ensuring enough liquidity are necessary for the day-to-day operations and lasting stability of a business. Furthermore, critical economic monitoring includes danger evaluation and mitigation strategies. By identifying monetary risks such as market volatility, credit rating risks, or regulatory changes, business can proactively apply actions to secure their economic security.

In addition, financial reporting and evaluation play an essential function in tactical decision-making. By generating exact financial records and performing in-depth analysis, organizations can gain valuable understandings right into their economic performance, determine locations for renovation, and make informed tactical selections that drive sustainable growth and earnings.

Development and Expansion Methods

To drive a company in the direction of increased market presence and profitability, calculated growth and growth strategies need to be thoroughly developed and implemented. One efficient approach for growth is diversification, where a firm enters new markets or deals brand-new products or services to exploit and decrease dangers on emerging chances. It is important for firms to conduct complete market research, financial analysis, and danger assessments before beginning on any kind of development strategy to guarantee sustainability and success.

Conclusion

To conclude, browsing the complexities of company development needs mindful consideration of business structure, legal compliance, tax planning, economic monitoring, and growth methods. By purposefully selecting the appropriate business framework, making certain legal conformity, preparing for taxes, handling funds properly, and executing development techniques, firms can set themselves up for success in the affordable company setting. It is necessary for businesses to come close to firm formation with a thorough and tactical attitude to achieve long-lasting success.

In the world of company formation, the essential decision of picking the appropriate service framework lays the foundation for the entity's lawful and functional framework. Entrepreneurs click here to find out more need to meticulously continue reading this assess the offered alternatives, such as sole proprietorship, partnership, restricted liability business (LLC), or corporation, to identify the most ideal framework that straightens with their business goals and scenarios.

By developing thorough budgets that line up with the firm's objectives and purposes, businesses can assign resources efficiently and track performance versus monetary targets.

In final thought, browsing the complexities of business formation calls for careful consideration of business structure, lawful conformity, tax obligation preparation, economic monitoring, and development approaches. By purposefully picking the appropriate organization structure, guaranteeing legal compliance, intending for tax obligations, taking care of financial resources successfully, and implementing growth strategies, firms can establish themselves up for success in the affordable company environment.

Report this wiki page